In the dynamic world of business, every significant decision hinges on a fundamental question: "Is this worth it?" The answer isn't always obvious, nor is it purely about the sticker price. True insight demands a deeper dive into the interplay of Price, Value, and Cost-Benefit Analysis. It's the difference between merely spending money and strategically investing it for maximum return.

This isn't just theory; it's the bedrock of sound business strategy, enabling leaders to cut through emotion and gut feelings, anchoring choices in data and objective financial reality. Whether you're a startup founder weighing a new marketing campaign or an enterprise executive considering a multi-million dollar acquisition, mastering this triumvirate is non-negotiable for sustainable success.

At a Glance: What You'll Learn

- The crucial distinctions between price, value, and cost.

- How Cost-Benefit Analysis (CBA) provides a data-driven framework for decision-making.

- The comprehensive list of explicit, implicit, direct, and indirect costs and benefits to consider in any project.

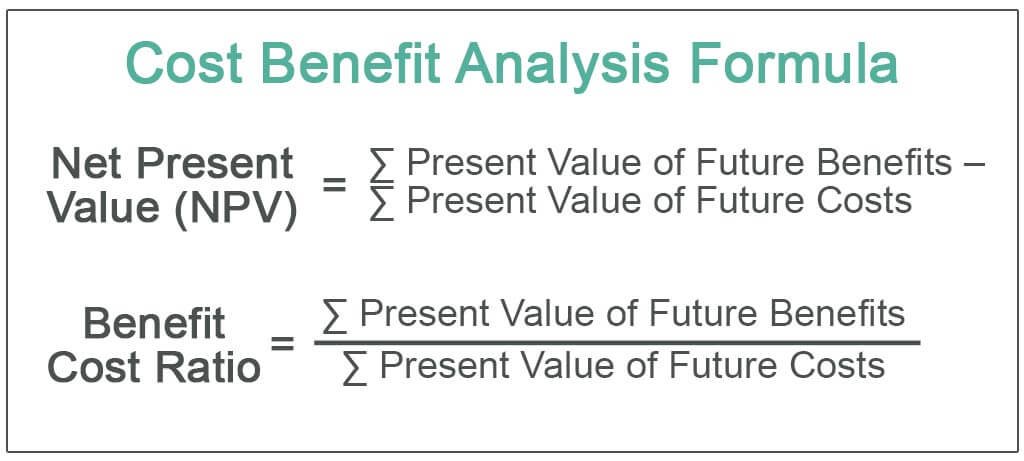

- Key formulas like Net Present Value (NPV) and the CBA ratio, and how to apply them.

- A step-by-step guide to conducting a thorough CBA for your initiatives.

- Real-world examples to illustrate CBA in action.

- Common challenges and pitfalls to avoid for a more accurate analysis.

- How technology can streamline and enhance your CBA process.

Beyond the Sticker: Unpacking Price, Value, and Cost

Before we dissect the analysis, let's align on the core concepts that often get conflated. Understanding their nuances is the first step toward smarter decisions.

Price: The Immediate Exchange

Price is straightforward: it's the monetary amount asked or paid for a good, service, or asset. It's quantifiable, immediate, and visible. When you buy a new piece of software for $500, that's its price. When you budget $10,000 for a marketing campaign, that's the price of launching it. Price reflects the expense you incur at the point of transaction.

Cost: The Full Financial Impact

Cost is a broader concept than price. While price is a component of cost, the total cost encompasses much more. It includes direct outlays (like the price of materials or labor), but also indirect expenses (overhead, administrative salaries), and often, "hidden" elements like opportunity costs (what you give up by choosing one path over another). A project's total cost isn't just its upfront price; it's the sum of all resources consumed over its lifecycle.

Value: The Perceived Worth

Value, unlike price or cost, is inherently subjective and relational. It's the benefit or utility an item, service, or action brings to you or your organization, relative to its cost. Something might have a low price but deliver immense value (e.g., a simple organizational hack that saves hours of work). Conversely, a high-priced item might deliver little value if it doesn't meet needs or provide significant benefits. Value is about impact, utility, and desirability. It's what makes customers choose your product, or what makes a new system worthwhile for your team.

The interplay: A high-priced item can be a great value if its benefits far outweigh its cost. A low-priced item can be a terrible value if it brings no discernible benefit or introduces significant problems down the line. The art of business decision-making lies in identifying and maximizing value, not just minimizing price.

The Powerhouse Tool: What is Cost-Benefit Analysis (CBA)?

Now, let's talk about the engine that brings price, value, and cost together: the Cost-Benefit Analysis (CBA). Also known as a benefit-cost analysis, a CBA is a systematic, data-driven process designed to help leaders make decisions that align with company goals, priorities, and budget realities.

Think of it as a comprehensive ledger that compares all the explicit and implicit costs of taking an action against all of its expected benefits. The magic happens when we assign monetary values to factors that might not have an explicit price tag, allowing for a truly holistic comparison.

Why do we do it?

A well-executed CBA helps you:

- Forecast Profitability: Get a clear picture of potential financial gains.

- Measure Financial Feasibility: Determine if a project makes economic sense.

- Optimize Resource Allocation: Decide where to best direct your limited funds, time, and personnel.

- Ultimately, choose the path that offers the greatest overall benefit for the incurred costs.

It’s about understanding the full economic picture, not just the initial cash outflow.

Why Every Smart Decision Needs a CBA

CBAs aren't just for mega-projects. They're versatile tools crucial for a wide array of business scenarios, from the mundane to the monumental.

Driving Smarter Project Planning

Considering a new initiative? A CBA helps you evaluate:

- Adding employees: What's the cost of salary and benefits versus the benefit of increased output, new skill sets, or reduced workload for existing staff?

- Purchasing new technology: The price of software or hardware is just one piece; what about implementation costs, training, and the benefits of efficiency gains, enhanced capabilities, or improved data security?

- Expanding facilities: Rent, utilities, maintenance, but also increased capacity, better employee morale, or strategic market positioning.

- Introducing new products or services: Development costs, marketing, distribution, weighed against new revenue streams, market share, and brand enhancement.

Guiding Strategic Decision-Making

When facing major strategic crossroads, a CBA provides clarity:

- Comparing multiple options: Should we invest in marketing automation or hire another salesperson?

- Evaluating an action against the status quo: Is upgrading our CRM worth the investment compared to sticking with our current, less efficient system?

- Major capital investments: Buying new machinery, building new infrastructure.

- Business process changes: Overhauling your supply chain or customer service flow.

- Organizational shifts: Restructuring teams or departments.

- Mergers, acquisitions, or divestitures: Understanding the true financial impact and strategic benefits.

Optimizing Budgeting and Resource Allocation

Every company operates with finite resources. CBAs help you stretch them further:

- Managing multiple projects with limited budgets: Which projects offer the highest return on investment (ROI)?

- Calculating ROI: Directly link investments to tangible returns.

- Optimizing resource distribution: Ensure your talent, time, and money are directed where they generate the most value.

Proactive Risk Management

CBAs aren't just about potential gains; they're about anticipating and mitigating downsides:

- Identifying potential issues: Budget overruns, scope creep, implementation delays.

- Assessing risks: Quantify the financial impact of potential problems.

- Allocating budgets for contingency measures: Build in safeguards to protect your investment.

Fostering Objective Decision-Making

One of the most powerful aspects of a CBA is its ability to neutralize bias.

- Removing emotion and personal opinions: It provides a financial context and data-driven justification, even for difficult choices that might be unpopular.

- Counteracting the "highest-paid person's opinion" (HiPPO): Data helps level the playing field, ensuring decisions are rooted in evidence, not just seniority.

Measuring Broader Impact

While often seen as a financial tool, CBAs can also help quantify the unquantifiable.

- Calculating a break-even point: By expressing intangible benefits as a "benefits value," finance teams can better project when an investment will pay off.

- Advancing broader goals: Incorporate factors beyond immediate profit, like long-term sustainability objectives, diversity and inclusion initiatives, enhanced employee well-being, or improved community relations. Even if these don't generate clear, immediate profit, their long-term value can be estimated and factored in.

Evaluating Past Decisions

A CBA isn't just forward-looking. Revisit previous CBAs to compare actual costs and ROI with initial projections. This post-mortem analysis refines your future analytical processes and improves forecasting accuracy.

Deconstructing a CBA: Identifying All Costs and Benefits

The core of any robust CBA is a thorough identification of everything that goes into (costs) and comes out of (benefits) a project. This requires a sharp eye and a willingness to look beyond the obvious. All costs and benefits should be considered over a defined timeframe, and importantly, adjusted for the time value of money using a discount rate.

The Cost Side: What You're Really Giving Up

Costs in a CBA go far beyond the purchase price. They represent all the resources, both tangible and intangible, expended or forgone.

- Explicit (Direct) Costs: These are the straightforward accounting costs with clear monetary values.

- Examples: Labor wages, raw materials, manufacturing expenses, software licenses, machinery purchases, supplies, advertising spend.

- Think: What's on the invoice or payroll?

- Indirect Costs: These costs aren't directly tied to a specific product or service but are necessary for general operations.

- Examples: Office rent, administrative salaries, utilities, insurance, general overheads, IT infrastructure maintenance.

- Think: The underlying expenses of keeping the lights on.

- Intangible Costs: These are qualitative items that are difficult to measure monetarily but represent real detriments.

- Examples: A decrease in employee productivity due to a disruptive new system, loss of brand goodwill from a failed product launch, reduced customer satisfaction, employee morale issues, increased stress.

- Think: The hidden human and reputational toll.

- Implicit (Opportunity) Costs: This is a crucial economic concept representing the benefit lost by pursuing one option over another, or by taking no action at all. It always has a quantitative value, even if not an explicit monetary outlay.

- Examples: If you invest $1 million in Project A, the opportunity cost is the profit you could have earned by investing that $1 million in Project B. If you decide not to upgrade outdated equipment, the opportunity cost might be the efficiency gains or competitive advantage you miss out on.

- Think: The "road not taken" and its financial consequences.

The Benefit Side: What You Truly Gain

Benefits are the positive outcomes of your action, ranging from easily quantifiable financial gains to less tangible improvements.

- Direct (Tangible) Benefits: These are easily quantified and measured in monetary value.

- Examples: Increased revenue from new sales, direct cost savings (e.g., lower operating expenses from automation), increased efficiency leading to higher output per employee, reduced waste.

- Think: Clear, measurable improvements to the bottom line.

- Indirect Benefits: These are tangential positive outcomes that aren't the primary goal but still add value.

- Examples: Customers being incentivized to spend more due to a new loyalty program made possible by new technology; improved public perception following a sustainability initiative.

- Think: The ripple effect of positive change.

- Intangible Benefits: These are difficult to measure monetarily but represent significant positive impacts.

- Examples: Improved customer satisfaction, enhanced brand reputation, higher employee morale, increased employee safety, strengthened thought leadership in the industry, better work-life balance for staff.

- Think: The qualitative upsides that build long-term strength.

- Competitive Benefits: Advantages gained over rivals.

- Examples: Gaining a significant competitive edge through innovation, increasing market share, achieving first-mover advantage, improving customer retention relative to competitors.

- Think: Strategic advantages in the marketplace.

Crunching the Numbers: Essential Formulas for Your CBA

Once you've meticulously identified all costs and benefits, it's time to quantify them. While assigning monetary values to intangibles requires judgment, the tangible elements allow for precise calculation. Here are the core formulas that bring your CBA to life.

The CBA Ratio

The CBA ratio provides a simple, at-a-glance comparison of total benefits to total costs.

CBA Ratio = Projected benefits / Projected costs

- A ratio greater than 1 suggests that the benefits outweigh the costs, making the project potentially viable.

- A ratio less than 1 indicates that costs exceed benefits, suggesting the project may not be financially sound.

- A ratio equal to 1 means benefits precisely equal costs (a break-even scenario).

Net Present Value (NPV)

NPV is arguably the most robust metric for a CBA because it accounts for the time value of money. A dollar today is worth more than a dollar tomorrow due to inflation and potential investment returns. NPV discounts future cash flows (benefits and costs) back to their present value, providing a more accurate picture of a project's true worth.

Simplified Formula: NPV = Present value of future benefits - Present value of future costs

Full Formula: NPV = ∑t=0T{(Bt−Ct)/(1+i)t}

Where:

- NPV = Net Present Value

- t = time period (starting from 0, representing today, up to T, the project's end)

- Bt = cash inflow (benefits) at time t

- Ct = cash outflow (costs) at time t

- i = discount rate or interest rate (the rate of return a company expects or could earn on an alternative investment)

- A positive NPV (greater than zero) is a strong indicator that the project is likely profitable and adds value to the company.

- A negative NPV (less than zero) suggests the project will likely result in a net loss and should be reconsidered or rejected.

- A zero NPV means the project is expected to break even, covering its costs but generating no net profit.

Understanding the Discount Rate (i)

The discount rate is critical for NPV calculations. It's the rate of return a company must earn from a project to be profitable, reflecting the opportunity cost of capital and the inherent risk. Choosing the right discount rate is crucial for accurate analysis. Key approaches include:

- Capital Asset Pricing Model (CAPM): This model considers systematic or market risk. It's often used by publicly traded companies as it incorporates the risk-free rate, market risk premium, and the company's beta (a measure of its volatility relative to the market).

- Build-up Method (Weighted Average Cost of Capital - WACC): This method focuses on a company's specific capital structure (debt, equity). It calculates the average rate of return a company expects to pay to all its security holders, weighted by the proportion of each capital source. It's suitable for companies with detailed capital structure information.

- Fama-French Three-Factor Model: More comprehensive than CAPM, this model incorporates additional factors beyond market risk, specifically size (small-cap vs. large-cap) and value (value stocks vs. growth stocks), to provide more refined discount rate estimates.

Your Step-by-Step Guide to Conducting a Robust CBA

A systematic approach ensures nothing is missed and your analysis is as accurate and unbiased as possible.

1. Define Project Scope and Identify Stakeholders

Begin by clearly outlining the project's purpose, goals, objectives, necessary resources, timeline, and personnel. Crucially, involve all relevant stakeholders early on. They provide diverse perspectives and crucial data, especially regarding intangible costs and benefits.

- Action: Agree on the time horizon for the analysis (e.g., 3 years, 5 years). Ensure all financial data is in a common currency.

2. Identify All Costs and Benefits

This is the brainstorming phase. Leave no stone unturned. List every conceivable explicit, implicit, direct, indirect, tangible, and intangible cost and benefit associated with each action or project under consideration.

- Tip: Create separate lists for each alternative, including the "do nothing" option as a baseline.

3. Document Assumptions

Human judgment is inevitable, especially when assigning values to intangibles. Explicitly document any assumptions made when valuing implicit costs and benefits. This transparency allows for scrutiny and adjustments if assumptions change.

- Action: Note the rationale behind each significant assumption.

4. Assign Monetary Values

Quantify everything possible.

- Tangible items: Use market prices, historical data, vendor quotes, or internal financial records.

- Intangible items: This is where it gets challenging. Use established methods:

- Contingent Valuation Method (CVM): Survey stakeholders to ask how much they would be willing to pay for a benefit (e.g., improved reputation) or willing to accept to forgo a benefit.

- Hedonic Pricing: Analyze market prices of related goods/services to infer the value of intangible attributes (e.g., how much extra people pay for a safer car model implies the value of safety).

- Cost-Effectiveness Analysis (CEA): Compare the costs of different ways to achieve the same non-monetary benefit (e.g., how much does it cost to improve customer satisfaction by X% using different methods?).

- Specialized Software: Some advanced tools can assist in modeling and valuing complex intangible factors.

5. Calculate Net Present Value (NPV) and CBA Ratio

Armed with quantified costs and benefits, apply the formulas.

- Discount Rate: Select an appropriate discount rate (using CAPM, WACC, or Fama-French) that reflects your company's cost of capital and risk profile.

- Present Value: Calculate the present worth of all future cash inflows (benefits) and outflows (costs) using your chosen discount rate.

- Final Calculation: Determine the NPV (Present Value of Benefits - Present Value of Costs) and the CBA Ratio (Present Value of Benefits / Present Value of Costs).

6. Analyze Results and Make Informed Decisions

This is where the numbers meet strategic insight.

- Interpretation:

- A positive NPV (or CBA ratio > 1) suggests the project is financially beneficial.

- A negative NPV (or CBA ratio < 1) signals potential financial loss.

- A zero NPV indicates a break-even scenario.

- Beyond the Numbers: While the financial metrics are critical, senior leaders must integrate perspective. Consider company culture, values, long-term strategic goals, and market positioning. A project with a slightly lower NPV might still be strategically superior if it aligns perfectly with long-term vision or opens up new market opportunities.

- Comparison: Always compare alternatives against each other, and against the baseline of "doing nothing" (maintaining the status quo). This highlights the true opportunity cost of your choice.

Real-World Application: A SaaS Company's Channel Sales Dilemma

Let's illustrate a CBA with a practical example. Imagine a fictional SaaS provider debating between two growth strategies: expanding their sales team to target healthcare customers directly, or establishing an indirect channel sales program. For simplicity, let's look at the channel sales program vs. hiring a content writer for direct growth.

Scenario: The SaaS company considers establishing an indirect channel sales program for healthcare customers. Their average sale is $15,000/year for a 50-seat client, and partners earn a 20% commission.

Alternative (Rejected for this specific CBA, but noted as opportunity cost): Hiring a content writer, investing in new marketing tools, and running ad campaigns to gain 50 new healthcare customers for a cost of $350,000 ($100,000 FTE + $250,000 tools/ads).

CBA for the Indirect Channel Sales Program (3-Year Projection):

Year 1:

- Costs: $476,000 (includes program setup, partner recruitment, initial marketing support, channel manager salary).

- New Customers: 50

- Income (from new customers): 50 customers * $15,000/customer = $750,000

- Gross Profit (before discount rate): $750,000 (Income) - $476,000 (Costs) = $274,000

Year 2: - Costs: $918,000 (includes increased partner support, expanded marketing, additional channel personnel).

- New Customers: 100 (total customers now 150 - 50 from Year 1 + 100 new)

- Income (from new customers + renewals):

- Renewals from Year 1 customers: 50 * $15,000 = $750,000

- New customers Year 2: 100 * $15,000 = $1,500,000

- Total Income: $2,250,000

- Gross Profit (before discount rate): $2,250,000 (Income) - $918,000 (Costs) = $1,332,000

Year 3: - Costs: $1,752,000 (further scaling, more channel infrastructure, larger team).

- New Customers: 200 (total customers now 350 - 150 from previous years + 200 new)

- Income (from new customers + renewals):

- Renewals from Year 1 & 2 customers: 150 * $15,000 = $2,250,000

- New customers Year 3: 200 * $15,000 = $3,000,000

- Total Income: $5,250,000

- Gross Profit (before discount rate): $5,250,000 (Income) - $1,752,000 (Costs) = $3,498,000

Total Over 3 Years (simplified, without discounting for illustrative purposes): - Total Costs: $476,000 + $918,000 + $1,752,000 = $3,146,000

- Total Income: $750,000 + $2,250,000 + $5,250,000 = $8,250,000

- Total Gross Profit: $8,250,000 - $3,146,000 = $5,104,000

- Gross Margin: ($5,104,000 / $8,250,000) * 100 = 61.87%

Conclusion (without discounting): This simplified analysis suggests that the channel sales program generates a substantial gross profit over three years, with a healthy gross margin. When comparing this to the $350,000 cost of the content writer alternative (which only aims for 50 new customers, far less than the channel's 350 over 3 years), the channel program appears to be a much more scalable and profitable strategy, even before accounting for the time value of money. A full NPV calculation would refine these numbers, but the direction is clear.

Navigating the Pitfalls: Common Challenges in CBA

While powerful, CBAs are not without their complexities. Awareness of these challenges can help you conduct a more accurate and reliable analysis.

- Quantifying Intangibles: This remains the toughest hurdle. Assigning explicit monetary value to factors like brand reputation, employee morale, or improved customer satisfaction is inherently difficult and relies heavily on assumptions. Over- or under-estimation here can significantly skew results.

- Mitigation: Use a panel of experts, leverage specialized valuation methods, and clearly document all assumptions.

- Data Accuracy and Availability: The old adage "garbage in, garbage out" perfectly applies to CBAs. If your cost and benefit data is limited, dubious, or inaccurate, your results will be flawed, leading to false predictions.

- Mitigation: Invest in robust data collection systems, verify data sources, and cross-reference with multiple inputs.

- Forecasting Difficulty: Predicting future costs, revenues, and market conditions is inherently challenging, especially for projects with longer time horizons (e.g., beyond 3-5 years). Unforeseen events can render projections obsolete.

- Mitigation: Use scenario analysis (best-case, worst-case, most likely), apply sensitivity analysis to key variables, and update forecasts regularly.

- Bias: Human judgment, particularly in assigning values to intangibles, can introduce bias. Project advocates might inflate benefits, while skeptics might overestimate costs.

- Mitigation: Involve a diverse panel of experts, including external consultants if necessary, and establish clear, consistent valuation criteria.

- Unrecognized Constraints: Failing to account for real-world limitations can undermine your analysis. These might include limited skilled personnel, supply chain capacity issues, regulatory hurdles, or technological dependencies.

- Mitigation: Conduct a thorough resource audit and risk assessment during the scope definition phase.

- Double Counting: It's easy to accidentally count a benefit or a cost twice within the analysis, inflating its impact. For example, counting both increased sales and the revenue from increased sales as separate benefits.

- Mitigation: Clearly define each item and maintain meticulous documentation to ensure each factor is counted only once.

- Over-reliance: While a CBA is a critical tool, it shouldn't be the only factor in decision-making. Over-reliance on purely monetary figures can lead companies to overlook other crucial qualitative factors, strategic alignment, ethical considerations, or long-term brand building that might not immediately show up as a high NPV.

- Mitigation: Integrate CBA findings with strategic frameworks like SWOT analysis, PESTEL analysis, and stakeholder feedback to ensure a balanced perspective.

Leveraging Technology for a Smarter CBA

Modern business operations generate vast amounts of data, and technology is key to harnessing it for more effective CBAs.

- Integrated Finance and Accounting Software: Systems like ERPs (Enterprise Resource Planning) centralize transactional and financial data. This means easier access to historical costs, revenue figures, and operational expenses, significantly enhancing the accuracy of your cost and benefit estimates.

- Planning, Budgeting, and Forecasting (PB&F) Tools: These specialized tools provide dynamic models for projecting future cash flows, applying discount rates, and performing scenario analysis. They streamline the calculation of NPV and CBA ratios, reducing manual effort and potential errors.

- Data Analytics Platforms: Powerful analytics tools can help identify patterns in historical data, predict future trends, and even assist in assigning proxies for intangible benefits by correlating them with measurable outcomes.

- Collaboration Software: For larger, more complex CBAs involving multiple departments and stakeholders, collaboration platforms facilitate information sharing, assumption documentation, and consensus building, ensuring all perspectives are integrated seamlessly.

By leveraging these technologies, organizations can move from time-consuming, spreadsheet-based CBAs to more agile, accurate, and insightful analyses, leading to quicker and more confident decisions.

Making the Leap from Analysis to Action

Ultimately, the goal of understanding Price, Value, and Cost-Benefit Analysis is not just to conduct an exercise, but to empower intelligent action. A thorough CBA provides an invaluable framework, blending quantitative rigor with strategic foresight. It forces you to scrutinize every assumption, quantify every impact, and explicitly consider what you gain versus what you give up.

Remember, a CBA is a living document. It should be revisited, updated, and refined as projects progress and market conditions evolve. It's not a one-time calculation but a continuous process of learning and adaptation. By consistently applying this powerful analytical approach, you move beyond mere guesswork, equipping yourself to make smarter, more profitable, and truly value-driven decisions that propel your business forward.

So, the next time you face a significant business choice, don't just ask "What's the price?" Ask, "What's the value? And what does a comprehensive Cost-Benefit Analysis tell me is the smartest path forward?" Your bottom line will thank you for it.